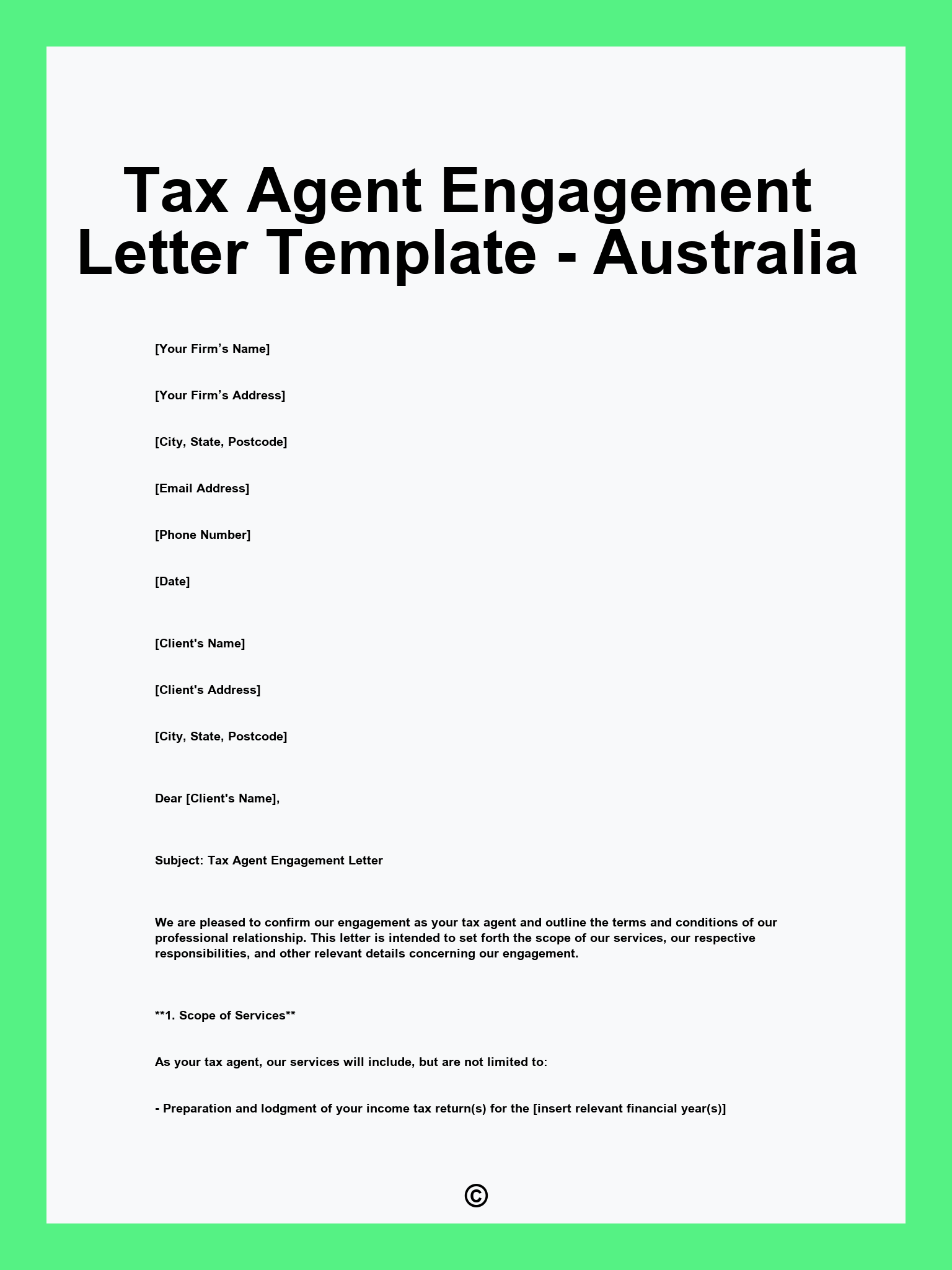

The Tax Agent Engagement Letter Template – Australia is provided in multiple formats, including PDF, Word, and Google Docs. These formats are both customizable and ready for printing, ensuring that they cater to your requirements effortlessly.

Tax Agent Engagement Letter Template – Australia Editable | PrintableSample

1. Parties Involved 2. Purpose of the Engagement 3. Scope of Services 4. Client Responsibilities 5. Fees and Payment Terms 6. Duration of Engagement 7. Termination Conditions 8. Confidentiality Obligations 9. Limitation of Liability 10. Governing Law 11. Signatures and Acceptance

PDF

WORD

Examples

[Client’s Name]

[Client’s Address]

[Client’s Phone]

[Client’s Email]

[Tax Agent’s Name]

[Tax Agent’s Firm]

[Firm’s Address]

[Firm’s Phone]

[Firm’s Email]

This Engagement Letter (“Letter”) confirms the understanding between [Client’s Name] and [Tax Agent’s Name] regarding the provision of tax agent services for the financial year ending [Year].

The Tax Agent will prepare and lodge the client’s income tax return, provide tax advice, and assist with any inquiries from the Australian Taxation Office (ATO).

The fees for the services will be discussed and agreed upon before the commencement of the work, and payment will be due upon completion or as per the agreed installment plan.

The Client agrees to provide all necessary documentation and information required for the Tax Agent to carry out the services effectively and in compliance with the law.

Both parties agree to keep all information exchanged during the course of this engagement confidential and to use it solely for the purposes of this agreement.

This engagement may be terminated by either party providing written notice of [Notice Period] to the other party.

The Tax Agent liability shall be limited to the fees paid for the services in the event of any claim arising from the engagement.

[Client’s Signature]

[Client’s Name]

[Tax Agent’s Signature]

[Tax Agent’s Name]

[Client’s Name]

[Client’s Address]

[Client’s Phone]

[Client’s Email]

[Tax Agent’s Name]

[Tax Agent’s Firm]

[Firm’s Address]

[Firm’s Phone]

[Firm’s Email]

This Engagement Letter (“Letter”) serves to outline the relationship between [Client’s Name] and [Tax Agent’s Name] for the provision of taxation services for the financial year ending [Year].

The Tax Agent shall provide services including tax return preparation, advice on taxation matters, and representation in disputes with the ATO.

The Tax Agent’s fees will be based on an hourly rate of [amount] or a fixed fee, agreed upon prior to the commencement of services.

The Client agrees to provide complete and accurate information and documentation to facilitate the Tax Agent’s services.

Both parties acknowledge the importance of data protection and agree to comply with all applicable privacy laws regarding personal data shared.

Either party may terminate the engagement with [Notice Period] written notice, or immediately for just cause.

Any disputes arising from this Letter shall be addressed through mediation before considering litigation.

[Client’s Signature]

[Client’s Name]

[Tax Agent’s Signature]

[Tax Agent’s Name]

Printable